2021 9M financial results and distribution of an interim dividend of € 0.127 per share

ALPHA TRUST-ANDROMEDA INVESTMENT TRUST S.A. reported in line with the International Financial Reporting Standards (IFRS) net profits of € 2.48 million in 2021 9M compared to losses of € -1.71 million in the same nine-month period in 2020.

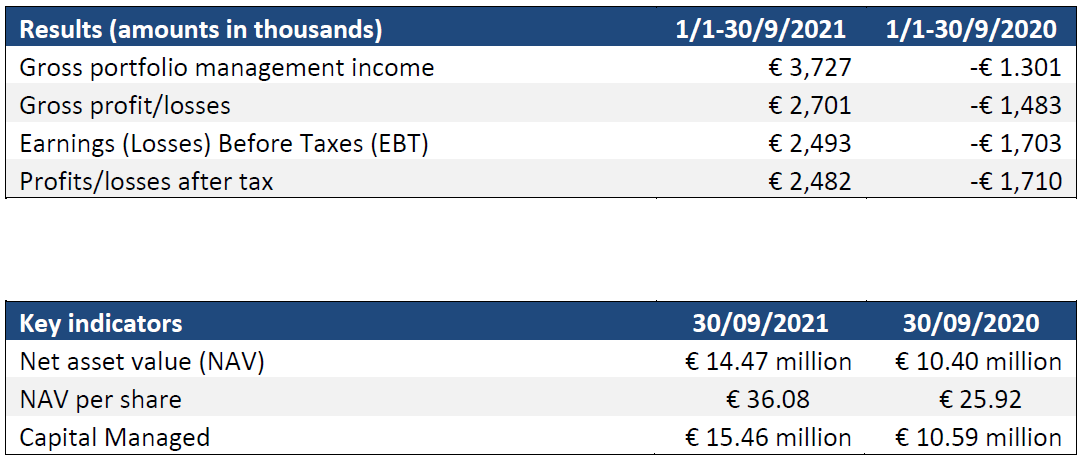

The Company’s key financials for 2021 9M were as follows:

Company gross income stood at € 3.73 million compared to losses of € 1.30 million in the same period last year. The source of gross income is primarily the profits from valuation of securities at fair value based on the IFRS and profits from sales and purchases of securities.

Earnings before tax stood at € 2.49 million compared to losses of € -1.70 million in the corresponding period last year. Earnings after tax stood at € 2.48 million in 2021 9M, against losses of € -1.71 million for 2020 9M.

In the period 1.1.2021 to 30.9.2021 the Company’s portfolio grew by 19.56% with the portfolio’s NAV standing at € 14.47 million or €36.07 per share on 30/09/2021.

From its establishment on 26.7.2000 up to 30.9.2021, ALPHA TRUST-ANDROMEDA INVESTMENT TRUST S.A.’s NAV has shown a return of +126.41%, outperforming the overall return of the ATHEX General Index by 185.26%, which for the same period reported a strongly negative return of -58.85%.

At the end of 2021 9M the Company’s portfolio was invested in its entirety in Greece, 87.99% in shares listed on ATHEX and 2.09% placed in bonds.

The Company’s five largest shareholdings at the end of the 9M period were: QUEST HOLDINGS S.A., THRACE PLASTICS HOLDINGS S.A., ELBE Industrial & Trading Co. S.A., TITAN S.A. and ENTERSOFT S.A.

ALPHA TRUST - ANDROMEDA INVESTMENT TRUST S.A. shares were traded on the Athens Stock Exchange at a significant discount of -21,36% on 03/11/2021, at a closing price of €7.45. It is worth noting that the Company’s Ordinary General Meeting of Shareholders held on 24/06/2021 decided to reduce the nominal value of the share from € 13.75 to € 3.4375 and at the same time to increase the total number of shares from 401,136 to 1,604,544 ordinary registered shares in a share split at a ratio of 4 new ordinary shares to replace every 1 old ordinary share.

The Company’s key financials and key indicators are presented in the following tables:

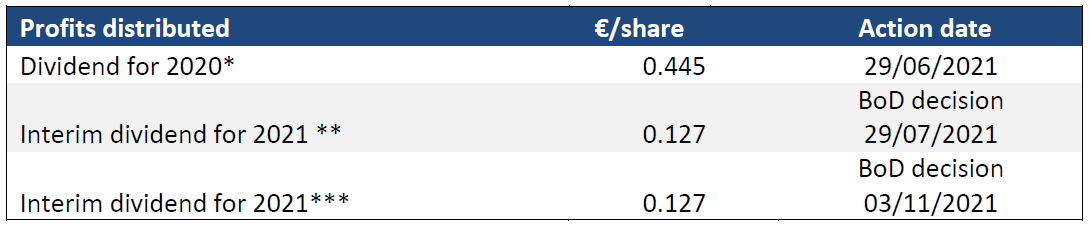

At its meeting on 3.11.2021 the Company’s Board of Directors decided to distribute € 200.57 K or € 0.127 per share as an additional interim dividend for the 2021 accounting period.

The table below shows the distributions of dividends and interim dividends made or approved for distribution from the start of the year:

* Adjusted to the new number of shares which arose after the split decided by the General Meeting on 24.6.2021 (4:1).

** The action date is expected to be set at some point after the first 15 days of December 2021.

*** The action date is expected to be set following approval and notification of the said corporate action by the competent authority.

Kifissia, 4.11.2021